Employee Ownership Basics

Employee Ownership Impact

In this video, learn about the powerful benefits of employee ownership. Discover how employee ownership not only serves as an effective succession plan for business owners but also strengthens local communities by promoting economic resilience.

The Iowa Center for Employee Ownership (IA-CEO) is a key resource, providing expert guidance for companies considering the transition to employee ownership. Explore how this model can secure your business's future while empowering employees and contributing to a stronger economy in Iowa.

Video credits: Weicks Media

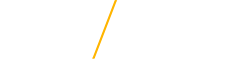

Employee Stock Ownership Plans (ESOPs) play a significant role in Iowa’s economy, strengthening businesses, supporting employees, and anchoring jobs in local communities.

The data below highlights the scale and impact of ESOPs across the state—from the number of employee-owners and companies involved to the benefits and assets generated through employee ownership.

Together, these numbers tell a powerful story about how ESOPs contribute to long-term business success and shared economic prosperity in Iowa.

Employee Ownership Basics

Employee ownership gives workers a stake in the businesses they help build, creating shared success for employees, companies, and communities.

What is Employee Ownership?

Employee ownership is a business model where employees hold significant ownership stakes in the company they work for. This can occur through programs like Employee Stock Ownership Plans (ESOPs), worker cooperatives or Employee Ownership Trusts (EOTs).

Employees benefit not only from their wages but also from the company’s financial success, fostering a vested interest in its performance. This structure encourages shared responsibility, long-term job security, and often promotes a collaborative culture, driving both individual and organizational success.

Why Does Employee Ownership Matter?

Employee ownership matters because it enhances engagement, commitment, and collaboration by giving employees a direct stake in the company’s success. It promotes long-term job security, often leads to higher wages, and helps employees build wealth through their ownership stakes.

Companies with employee ownership, particularly those with ESOPs, tend to perform better, demonstrate greater resilience during economic challenges, and have higher employee retention rates. The alignment of employee and company interests also fosters a shared sense of purpose and responsibility, leading to sustained organizational success.

Advantages of Employee Ownership

- Increased Productivity: Employees who have a stake in the company are more motivated and engaged, leading to higher productivity and better overall performance.

- Enhanced Retention: Employee-owned companies often experience lower turnover rates, as employees feel more invested in the company’s long-term success.

- Financial Benefits: Employees can build wealth through their ownership stakes, contributing to greater financial security and retirement savings.

- Business Resilience: Employee-owned companies tend to be more stable and resilient during economic downturns.

- Collaborative Culture: Ownership fosters a sense of shared responsibility, teamwork, and a stronger organizational culture.

Additional Resource

Introduction to Employee Ownership

What is an ESOP?

Employee Ownership Expansion Network: Is Selling to an ESOP Complex and Expensive?

What is a Worker Cooperative?

Workers to Owners: The Story of A Child's Place

Employee Ownership Transition

ShopBot Tools: Becoming an Employee Ownership Trust (EOT) from a small manufacture perspective

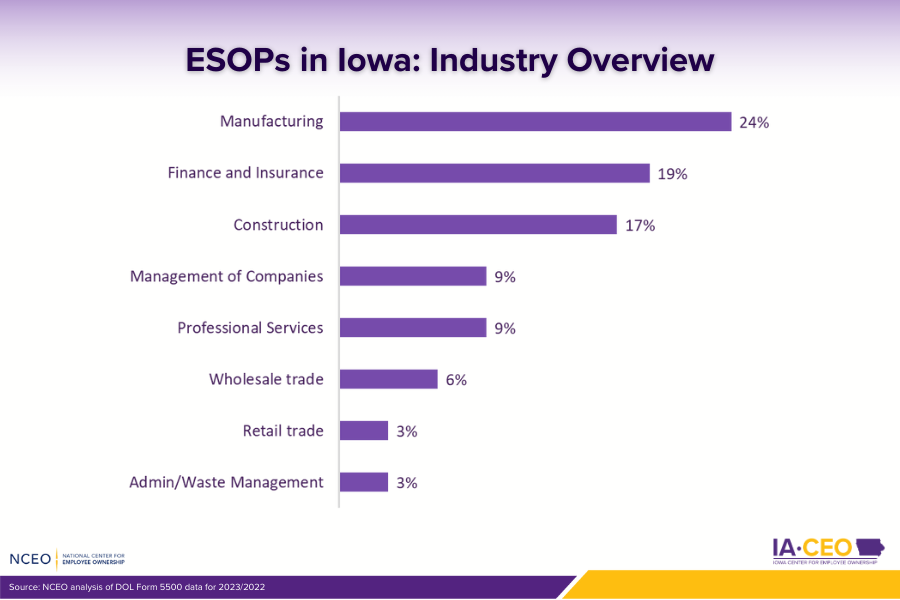

Employee Stock Ownership Plans (ESOPs) span a wide range of industries across Iowa, demonstrating the versatility and broad appeal of employee ownership. While manufacturing leads the way, ESOPs are also well represented in finance and insurance, construction, professional services, and other key sectors of the state’s economy.

This industry snapshot highlights where employee-owned companies are most prevalent and underscores how ESOPs support business continuity, workforce stability, and long-term growth across diverse fields.

A ‘Silver Tsunami’ is Hitting Rural America as Small Business Owners Retire Without Replacements

Over half of the businesses in the U.S. are owned by Baby Boomers and in a recent study, 75% of business owners would like to exit their businesses within the next 10 years.

Read the full article below to see how this has already started to impact and will continue to reshape communities across the Midwest and Great Plains in the coming years.

Iowa is home to a diverse and growing number of employee-owned companies across industries and regions. The organizations highlighted here represent just a sample of Iowa businesses that have chosen Employee Stock Ownership Plans (ESOPs) as a pathway to business continuity, shared success, and long-term local impact.

Together, they illustrate how employee ownership works in practice—strengthening companies, empowering employees, and keeping businesses rooted in Iowa communities.

Folience, Prairie Capital, Rayser Holdings, Stellar, VGM and Wright Service Corp.